1. INTRODUCTION

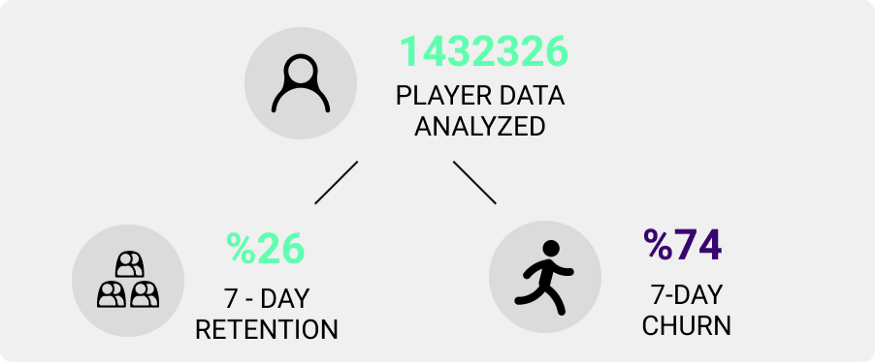

This report is prepared by the AppNava Team, which consists of awesome tech and mobile data experts who intend to revolutionize the mobile and digital world. AppNava is there to make apps and games richer and happier. It specializes in modeling complex player behavior for mobile games/applications, predicting your players’ future, and unleashing the power of data. We have been following the mobile game and data industry closely for years. We are happy to gather what we know and hear under important headings and present them to you.

Beginning from 2020, the pandemic, which turned many economies upside down on a global scale and caused devastating effects for many businesses, could not reflect this catastrophic effect on the digital world. In fact, on the contrary, the digital world has become a sector fed by the pandemic. With the increase in the time spent at home, people have increased the use of social media and started to find platforms where they can meet their socialization needs.

The pandemic, of course, has had unpredictable dire consequences for the whole world. However, the refreshing effect of the pandemic in the gaming industry, and especially in the mobile gaming industry, is undeniable. 2020 had experienced a golden age when mobile game revenues skyrocketed, and mobile player numbers reached incredible numbers. While 2020 was a good time for the game industry, could 2021 continue this beauty? What you will see in this report; What happened in the game world while the pandemic continued? Is the increase in revenues and player numbers continuing? Latest games and rankings? How did the advertising and user acquisition processes change with the new privacy policies? What are the effects of Metaverse, Blockchain, and NFTs in the gaming world? What are the latest trends and news? Welcome to the 2021 Global and Mobile Gaming Report, where you will find answers to questions with AppNava.

2. EXECUTIVE SUMMARY

With the epidemic, the rules of the game world were rewritten. Due to the unprecedented effects of 2020 on the digital world and shaking the market, 2021 seems not to be as glorious as 2020. The most shocking event of this period is undoubtedly Apple’s privacy-friendly attitude. Apple’s removal of IDFA negatively affected the global digital advertising industry and different gaming market sectors. The process of adapting to SKAdNetwork, which has replaced IDFA, was painful in 2021 (1). However, game companies are still adapting to this change. With this change, where data has become even more important, we, as AppNava, have supported our game studios with smart solutions for the iOS15, SKAdNetwork by using our data processing & data science power.

Despite so much change and confusion, the game industry continued to grow exponentially. Total gaming revenue is $175.8 billion, with the Asia Pacific accounting for more than half of that revenue, $88.2 billion. When we look at the developments, it will not leave the leadership for many years. In 2020, revenue of $177.8 billion was generated. There seems to be a slight decrease in 2021. This is because the pandemic is slowly losing its effect.

On the other hand, the mobile game market reached $90.7 billion (2). Also, the metaverse movement is accelerating, and it doesn’t look like it will stop. The metaverse, which allows users to create new worlds online, will make the future of the gaming world in particular. Even well-known technology leaders are trying to be metadatabase-oriented in the future. As in 2020, interest in e-sports was great in 2021 as well. Multiplayer games have an audience almost as passionate as traditional sports fans. An e-sports award ceremony is held annually to select and crown the best in e-sports (2). The best player of 2021 has been Oleksandr “s1mple” Kostyliev (3). Looking at the statistical evaluations of 2021, Asia Pacific has not lost its leadership with the highest revenue as last year. As it is felt, the digital world has become almost as important as the real world. Change and transformation will continue to happen in 2021, and we will see what awaits us in 2022.

3. GLOBAL & MOBILE GAME MARKET TRENDS & NEWS

3.1 Surprising news for advertisers: Apple’s removal of IDFA

With Apple’s newest iOS 15 update & SKAdNetwork, a privacy-friendly change, a new era for the advertising industry started and is already in our lives. The purpose of the new system is to protect user-level and device-level private information.

Previously, the “Identifier for Advertisers” enabled advertisers to track a user’s interactions, such as clicks and purchases in mobile apps. It monitors ad performance, which is vital for the advertiser. Therefore, IDFA is essential for user acquisition processes and mobile advertising platforms. However, Apple closed the IDFA era with iOS 15 and replaced it with a new advertising framework, SKadNetwork. Likewise, with iOS 15, Apple introduced a new feature called Application Tracking Transparency (ATT) instead of IDFA.

The removal of IDFA was a significant source of stress for mobile game advertising in the beginning. According to the research survey of ATT participation rates dated April 2021; Casual games took first place with an opt-in rate of 36%. Mid Core games have a 32% opt-in rate. Unfortunately, social casinos and hyper-casual games showed 21% and 12% lower engagement rates. Looking at ATT opt-in rate distribution per app, it is seen that half of the applications have a participation rate exceeding 29% (4). This means users can accept being tracked for a better user experience.

3.2 Metaverse new game framework

Covid-19 has caused people to lead their lives online. So it was inevitable that people wanted to expand the boundaries of their online world. Although the term metaverse was first used by science fiction writer Neal Stephenson in 1992, it received much attention during and after the pandemic. Metaverse is the concept of multiple virtual worlds where everything you can imagine in the digital environment is unlimited using virtual reality. Meta universe; It allows users to do whatever they want in these 3D worlds. Video games are currently the most direct route to the meta-universe.

There are also meta-universe-like blockchain applications. For example, Axie Infinity is a “play-to-win” game. Users play this game to earn more income. Metaverse, blockchain, and NFTs are terms that feed off each other. Axie Infinity uses Ethereum-based cryptocurrencies. Prominent technology leaders are trying to be metaverse-oriented in the future. Having bought the Oculus company, which works on virtual reality devices, Facebook is one of the most crucial metaverse investors globally. In 2021, Facebook changed its corporate name to Meta and underwent a major brand overhaul. After Facebook announced its new name, interest in metaverse-oriented cryptocurrencies peaked.

In addition, game sites such as Roblox are making serious investments in this area. With the outbreak, Roblox has increased its player base to more than 164 million active users in August 2020 (1) (5). Sandbox is a game that offers a blockchain-based metaverse experience. You can create and sell items in the game; these transactions are done with SAND, the cryptocurrency of the universe. The year 2020 witnessed many virtual concerts. Travis Scott and his performance in Fortnite, Lil Nas X’s performance in Roblox also made people curious about the game environment even they didn’t interest in before. 2021 was a year in which this curiosity was satisfied (2) (6) (7).

3.3 Progress to the big future with small steps: 5G penetration

We can briefly define 5G technology as the fifth-generation wireless network technology. Unfortunately, the epidemic caused problems in the distribution of 5G. Despite this, many data show that the spread of 5G will accelerate in the future. As the penetration of smartphones, from small to large, can not be put down by anyone, the game market is also expanding. The most important reasons for this increase are higher speed, energy efficiency, reduced latency, and increased reliability. Another feature of 5G is that it offers increased capacity.

According to research, while the number of global smartphone users was 3.9 billion in 2021, the projected number for 2024 is 4.5 billion. By moving games and movies to the cloud environment, it has already become possible for users to open them on their computers that are not equipped with high hardware. 5G, which is growing and is sure to grow even more in the future, can comfortably offer a cloud gaming experience (1) (6) (8).

3.4 Cloud gaming replaces consoles

Cloud computing is an internet-based file storage and synchronization service. Cloud communication services have become the building blocks of the internet world, mainly thanks to their intense use in the last period. The gaming industry has grown tremendously during the pandemic, and cloud gaming has come to the fore with its convenience and practicality in gaming. The thing that will best describe cloud gaming is this; users experience gaming by using lower-equipped mobile phones, tablets, or PCs instead of hardware that they can purchase at very high prices.

The emergence of hardware-intensive and quality games day by day will attract players to the world of cloud games. As cloud gaming becomes widespread and develops, the need for fast, lag-free, and uninterrupted internet emerges. 5G gets involved here. As the rise of cloud game continues, the spread of 5G will become imperative. According to research, global cloud gaming revenues for 2021 are $1.6 billion, and users paying for global cloud gaming in 2021 are 23.7 million (1) (8) (2) (9).

3.5 Millions of people watching e-sports

With the increase in the time spent at home, the interest in games and social media has increased, especially online platforms where people can socialize and feel like they are doing something together have increased their popularity. Especially during the quarantine times, game contents containing video chat appeared. With that, e-sports and live streams are on the rise.

E-sports, just like traditional sports, involves a great competitive environment. RTS (Real-Time Strategy), MOBA (Multiplayer Online Battle Arena), FPS (First-Person Shooter), Battle Royale PvP (Player vs. Player) are e-sports related games. Competition is high, especially in Moba and RTS games. StarCraft is an RTS game and was one of the first games in a competitive tournament. Dota 2 and League of Legends are other competitive MOBA games.

E-sports has a fan base, which has grown thanks to living broadcasts. Twitch and Youtube are among the places where players broadcast. In 2020, Twitch’s Just Chatting category surpassed game views and ranked 1st. With the pandemic, people’s need to socialize has left League of Legends watching in the 2nd place. According to research, mobile esports games like PUBG Mobile and Garena Free Fire witnessed a higher esports audience than PC games like CS: GO and Dota 2 (1) (6) (2) (10).

4. GLOBAL & MOBILE GAME MARKET STATISTICS

4.1 Global games market by region

The Global Game Market experienced its golden age in 2020 and continued its rise in 2021. In the regional research, it has been seen that the total game income is $175.8 billion. Looking at revenues by region, Asia Pacific is the leader of the game world (2) (5).

Asia Pacific; among the game genres, it is mainly directed towards social multiplayer games. Mobile games are the most preferred games. The regional research shows that consumer spendings correspond to two-thirds of all consumer spending (2).

Asia-Pacific holds half of the global gaming market with $88.2 billion revenue. North America comes in second with $42.6 billion. Next is Europe, with $31.5 billion in revenue. Latin America and the Middle East and Africa are ranked last, with $7.2 billion and $6.3 billion (5).

Tencent, the owner of We Chat, continues to blur the lines of the game and non-game platforms by producing games with vast social opportunities, such as Honor of Kings. Communication has become vital both in-game and on game-related platforms. It is an undeniable fact that the Asia Pacific dominates the gaming world.

The research shows that these players prefer mobile games. North America ranks second in global gaming revenue. Console games are first in North America, but there is a slight difference with mobile games. The world is very interested in mobile games. As mobile game players increase, mobile game developers and mobile game advertisers will grow (11).

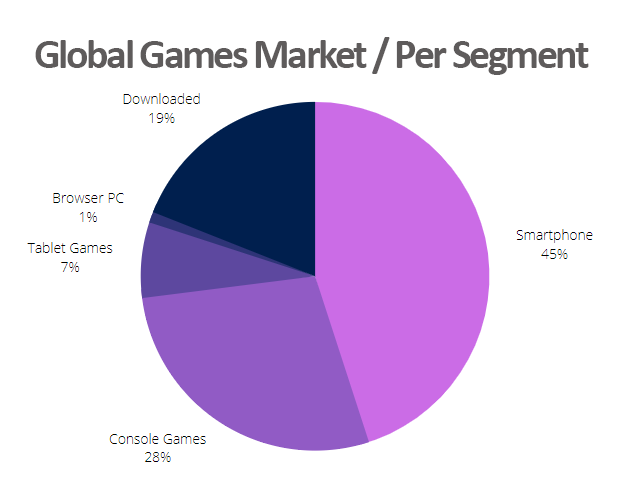

4.2 Global games market by segment

In the research, it is seen that the smartphone is the most preferred for playing games. The use of smartphones is increasing day by day. They are the most preferred smartphone games with a 45% rate and $79 billion revenue in the global game market. Console Games is in second place with $49.2 billion revenue. Downloaded/Boxed PC Games is in third place with $33.3 billion, Tablet Games with $11.6 billion, and Browser PC Games with $2.6 billion in last place in terms of preference (9) (8) (10) (1).

The mobile gaming industry has been a bombshell with miHoYo’s Genshin Impact game. The main feature of AAA games is the open-world gameplay and the incredible quality of the graphics. Genshin Impact brings these features to the phone, giving the player an excellent gaming experience on their phone. The fact that the games that we could only play on the computer before can be played on the phones quickly increases the number of games played on the phones (12).

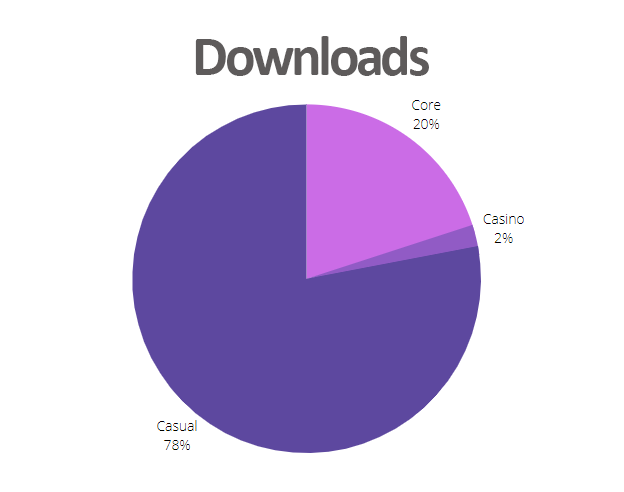

4.3 Gaming genres by downloads, consumer spend and time spent

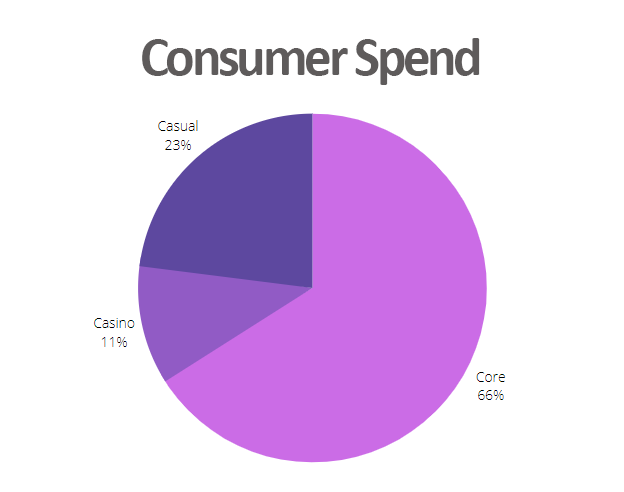

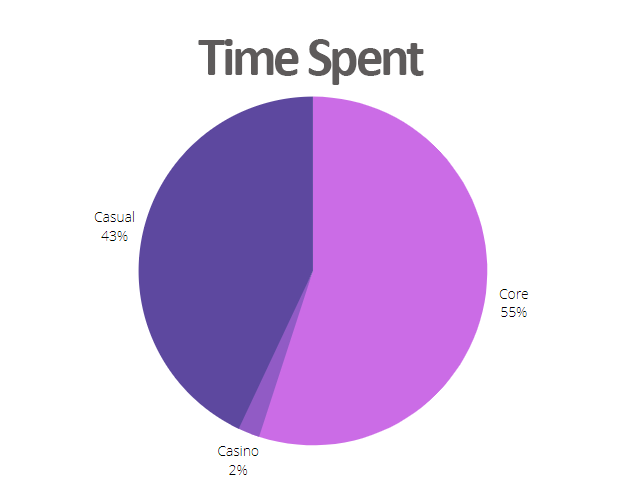

Casual games are a type of mobile game that is simple to play and has a low barrier to entry. In the continuation of the research, it is seen that Core Games ranks first in terms of consumer spending, and when we look at the time spent in games, the core game and casual game are close to each other.

As you can see above, Casual games dominate downloads with 78%. The reasons for this are; Simple gameplay is that it gives very short chapters and missions.

Core Games is a free-to-play online video game with a built-in game development framework.While casual games generate the most downloads, core games generate the most spend (66%).

Core games are where gamers spend 55 percent of their time. The difference with the casual game is quite small.

4.4 Mobile game market by downloads

According to research; In December 2021, the worldwide mobile game market reached $4.9 billion downloads on the App Store and Google Play, increasing 1.8 percent compared to the previous year. India is responsible for 717.4 million global game downloads, or 14.8 percent of worldwide downloads. The United States was second with about 9% of all downloads, followed by Brazil with 8.2%. As a result of the research, the most downloaded mobile games of 2021 are listed as follows; Subway Surfers tops the list with 191 million downloads. Roblox followed with 182 million downloads, with Bridge Race in third place with 169 million. Garena Free Fire — New Age ranks fourth with 154 million downloads. In 5th place is Among Us with 152 million downloads (13) (14).

· Subway Surfers

In 2012, Kiloo and SYBO Games collaborated to create Subway Surfers, an endless runner mobile game. In this game, players take on the role of young graffiti painters running away from the inspector and his dog at a subway station. The most significant achievement of Subway Surfers developers is that they have reached a record number of downloads in the last ten years. According to the research; Looking at the year 2021, the number of Subway Surfers downloads is 191 million. In total, the number of downloads is almost one-third of the population (15).

· Roblox

Roblox Corporation, which was founded in 2006, developed the Roblox platform. Roblox allows users to create their own games and also play games created by others. Roblox allows players to construct a virtual universe in which they are the developers of their own game. As a result of this situation, many child developers earn from the game. Since February, the number of active Roblox players has climbed by nearly 35% to 164 million in July. Players can upgrade to premium membership and purchase Robux, an in-game money that allows them to purchase clothing and weapons for their avatars. Roblox is, without a doubt, a platform that provides a metaverse experience (14) (15).

5. BREAKING NEWS

As technology developed, the news we read changed one by one. Earlier, it seemed impossible for us to talk about the metaverse and NFT or the winning team and the best player in esports. In the new world, this is all perfectly normal. On the other hand, purchases in the gaming world reached a high level in 2021 and exceeded the full-year total of the last five years. Acquisitions and mergers allow large companies to leverage other companies and expand in the direction they want to focus. They have become a common business strategy for firms looking to develop new markets or regions and acquire new technology and capabilities.

5.1 Netflix stepped into the gaming world

An exciting development in the mobile game industry occurred on November 3, 2021. Netflix made its first step into the gaming sector by broadening the scope of its services. The company has released five games that can be accessed on Android devices and made available to all its subscribers. These games are Stranger Things: 1984, Stranger Things 3: The Game, Shooting Hoops, Card Blast, and Teeter Up. It announced that its games, which were initially only suitable for Android, will soon come with iOS support. The games were also made available to iOS users a week after the announcement. The company has signaled that it will achieve much more in the mobile gaming industry and offer ad-free and in-app payment-free gaming experiences.

5.2 Zynga stepped into the NFT industry

Towards the end of 2021, Zynga stepped into the NFT industry and appointed Matt Wolf as vice president of Blockchain Gaming. They decided to integrate emerging technologies, blockchain systems, and NFTs into their games. Wolf announced that he would work on it. Zynga also announced that they would develop new games compatible with NFT and blockchain. In this way, Zynga expanded its growth strategies and targets into new areas.

5.3 Four major acquisitions in the mobile gaming world

Nordisk Games acquires majority stake in Star Stable Entertainment

Swedish game development studio Star Stable Entertainment is the developer of Star Stable Online. This game is the world’s first and only multiplayer role-playing horse adventure game. Nordisk Games is owned by entertainment company Nordisk Film, part of Egmont, a leading Nordic media group, and has increased its stake in Star Stable Entertainment. The purchase of additional shares from existing shareholders means Nordisk Games’ stake in the company is approaching 57%. “What we love about Johan and the Star Stable Entertainment team is that they stay true to their vision of creating a game that is so different from anything else on the market,” said Mikkel Weider, general manager of Nordisk Games (16) (17).

Thunderful acquires mobile developer Early Morning Studio

Thunderful Group has taken an excellent step to expand into the mobile gaming market alongside Console and PC. Swedish game group Thunderful Group has added Swedish mobile game developer Early Morning Studio to its team. Early Morning Studio is the developer of well-known games such as Vampire’s Fall: Origins, Champions of Avan, and the yet unreleased Vendir: Plague of Lies.

2021 is full of impressive acquisitions for Thunderful. Bridge Constructor publisher Headup Games has acquired Spanish developer Stage Clear Studios and game consulting firm Robot Teddy. Early Morning is the fourth studio the company has acquired this year (18).

Zynga acquires three Turkish hyper-casual studios

Last year, Zynga acquired hyper-casual game maker Rollic. In 2021, Zynga added three hyper-daily game studios, ByteTyper, Creasaur Entertainment, and Zerosum, through Rollic to its family. These three studios are known for games like Firefighter Hero, Racing Online, Touchdrawn, Barista Life, Money Maker 3D, and more. All these games have been heavily downloaded in the app stores (19) (20).

Sandbox acquires Edujoy and Tellmewow, two mobile game makers

Tellmewow develops games and puzzles for adults, while Edujoy develops educational games for babies, toddlers, and children up to 8 years old. Edujoy has collaborated with well-known children’s brands like Hello Kitty (21). Bhav Singh, CEO of Sandbox, spoke about the acquisition: “We are excited to welcome Edujoy and Tellmewow to our Gaming family. We have been impressed with the scale and capabilities they have developed to date, and we are excited to work together to make learning fun for families around the world” (21).

6. FORECAST

We’ve talked a lot about the past and its both extraordinary and devastating effects. It’s time to turn our face a little to the future. The year we will leave behind has experienced many things that profoundly affected the gaming world. The pandemic is losing its effect with the vaccine, but it would not be right to expect game revenues to decrease. Many researchers have the idea that mobile game revenues will increase in 2022. It is estimated that there will be more than 3.07 billion mobile players worldwide by the end of 2023 (1).

On the other hand, 2021 experienced a new development challenge for advertisers. Even though Apple’s removal of IDFA came out in mid-2021, mobile game advertisers are still struggling to overcome its effects. This change will become much more important to integrate with marketing creatives and data science.

Games such as Axie Infinity and Roblox, which are among the most played games in 2021, will intensify the interest in the metaverse. Blockchain and NFT will be the titles we will see in the game world in the coming years.

There is always interest in puzzle games like Candy Crush, which has existed for years but never lost its popularity. But there are too many of these game types on the market. It is pretty popular to add new meta layers to games to stand out from other games. Project Makeover is a puzzle game, but it has different meta layers like storytelling and fashion.

Perhaps one of the most significant changes in our lives is esports, which will now surpass even traditional sports. The lines between mobile games, consoles, and pc are getting blurred. The success of Genshin Impact will enable us to experience even more AAA mobile games in 2022 (1) (13).

7. RESOURCES

1. Weustink, Jorik. Newzoo 2021 Trends to Watch Report. Newzoo. 26 02 2021. https://resources.newzoo.com/hubfs/Reports/2021_Newzoo_Trends_to_Watch_Report.pdf?utm_campaign=Global%20Mobile%20Market%20Report%202020&utm_medium=email&_hsmi=113081565&_hsenc=p2ANqtz-9sYHQdpv00DmV1xPoy0PfCBv6BeGFpSLwk7AkjZZQOaUjdKci6_MgVIRxooFO0tCJfEhXj6.

2. 2021 Free Global Games Market Report Newzoo. 30 06 2021. https://resources.newzoo.com/hubfs/Reports/2021_Free_Global_Games_Market_Report.pdf?utm_campaign=GGMR%202021&utm_medium=email&_hsmi=137510824&_hsenc=p2ANqtz-_r0sgzdHIT5hRwKYoyA8mle7tTks2kWNhEUl7QYbcZGtf6UPlO3UrKiyIQxjPz-kBXFcenW4v-z9wP_RWUv_i0DOkPzA&utm_c.

3. Esports Awards 2021: All winners & nominees. DEXERTO. 21 11 2021. https://www.dexerto.com/esports/esports-awards-2021-categories-nominees-how-to-vote-1666241/.

4. Rosenfelder, Shani. Initial data indicates ATT opt-in rates are much higher than anticipated — at least 41%. AppsFlyer. 8 04 2021. https://www.appsflyer.com/blog/trends-insights/att-opt-in-rates-higher/.

5. Beyond 2021: Google User Content. 19 10 2021. https://kstatic.googleusercontent.com/files/875daedd74da7be2436d2fea45dede60360f6e061bc992e1785af710dd4c534488ddbf45c278e5d29db4fffbe0710f019956420ee0cf1242014e55e6f4d654db.

6. Knezovic, Andrea. Global Gaming Market in 2021 + Top Mobile Games & Genres. Udonis. 29 04 2021. https://www.blog.udonis.co/mobile-marketing/mobile-games/gaming-market-top-games.

7. Silvija. Meta Layer Monetization: Analyzing the Big Mobile Gaming Trend. Udonis. 15 06 2021. https://www.blog.udonis.co/mobile-marketing/mobile-games/meta-layer-monetization.

8. Newzoo 2021 Cloud Gaming Market Report. Newzoo. 02 09 2021. https://resources.newzoo.com/hubfs/Reports/Newzoo_Free_2021_Cloud_Gaming_Market_Report.pdf?utm_medium=email&_hsmi=152659873&_hsenc=p2ANqtz--1659ZY5AcytQF_KWrWfx4OEuilRRUaDgYfz7G3EUK51YpwdSAxneyjYrgtNexaH1DKGvnKRdt_VT-vUNUP3Lk9LzFVQ&utm_content=152659873&u.

9. Gu, Tianyi. The Evolution of Gaming through 5G. Newzoo. 9 03 2020. https://armkeil.blob.core.windows.net/developer/Files/pdf/report/the-evolution-of-gaming-through-5g.pdf.

10. Silvija. Mobile Marketing Trends for 2022 (Including Statements from Industry Leaders). Udonis. 01 2021.

11. Rohini Bhushan, Tony Habschmidt. Beyond 2021: What’s next for gaming in APAC? Google. December 2021. https://www.thinkwithgoogle.com/intl/en-apac/consumer-insights/consumer-trends/beyond-2021-gaming-insights-trends-apac/.

12. Grguric, Mihovil. Genshin Impact’s Developer miHoYo Sues Bilibili. udonis. 9 September 2021. https://www.blog.udonis.co/news/mihoyo-sues-bilibili.

13. Knezovic, Andrea. Global Gaming Market in 2021 + Top Mobile Games & Genres. udonis. 29 April 2021. https://www.blog.udonis.co/mobile-marketing/mobile-games/gaming-market-top-games.

14. Koetsier, John. Top 10 Most Downloaded Apps And Games Of 2021: TikTok, Telegram Big Winners. Forbes. December 2021. https://www.forbes.com/sites/johnkoetsier/2021/12/27/top-10-most-downloaded-apps-and-games-of-2021-tiktok-telegram-big-winners/?sh=450f08013a1f.

15. Top 10 Most Downloaded Apps And Games Of 2021: TikTok, Telegram Big Winners. Forbes. [27 December 2021. https://www.forbes.com/sites/johnkoetsier/2021/12/27/top-10-most-downloaded-apps-and-games-of-2021-tiktok-telegram-big-winners/?sh=450f08013a1f.

16. Grguric, Mihovil. Nordisk Games Becomes Majority Shareholder in Star Stable Entertainment. Udonis. 19 11 2021. https://medium.com/udonis/nordisk-games-becomes-majority-shareholder-in-star-stable-entertainment-f46ffff9dc8f.

17. Orr, Aaron. Nordisk Games acquires majority stake in Star Stable Entertainment. pocketgamer.biz. https://www.pocketgamer.biz/news/77583/nordisk-games-majority-stake-star-stable-entertainment/.

18. Thunderful acquires Early Morning Studio. gamesindustry.biz. 16 November 2021. https://www.gamesindustry.biz/articles/2021-11-16-thunderful-acquires-early-morning-studio.

19. Ha, Anthony. Zynga and Rollic acquire the hyper-casual game studio behind High Heels. Join TechCrunch+. 29 April 2021. https://techcrunch.com/2021/04/29/rollic-zynga-uncosoft/.

20. Grguric, Mihovil. Zynga Acquires 3 Turkish Hyper-Casual Studios. Udonis. 5 November 2021. https://www.blog.udonis.co/news/zynga-acquires-3-turkish-hyper-casual-studios.

21. Tuchow, Ryan. Sandbox Acquires Two Mobile Game Makers. kidscreen. 15 November 2021. https://kidscreen.com/2021/11/15/sandbox-acquires-two-mobile-game-makers/.